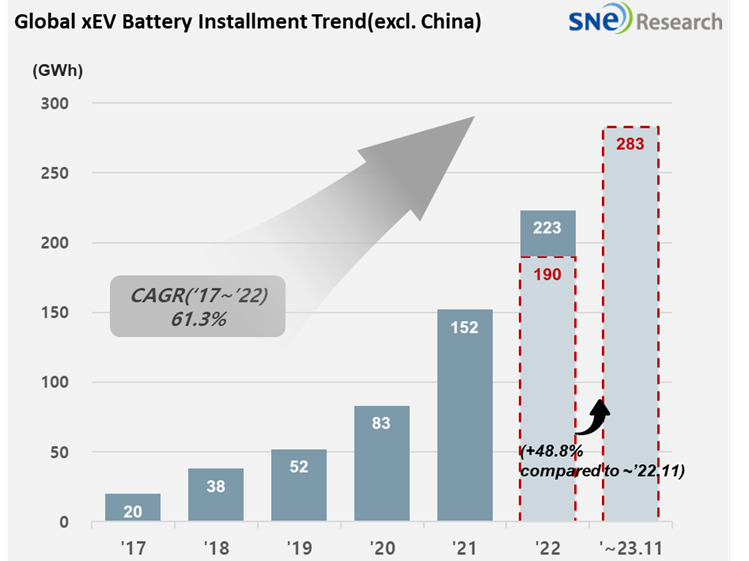

From Jan to Nov in 2023, Non-Chinese Global[1] EV Battery Usage[2] Posted 282.9GWh, a 48.8% YoY Growth

- K-trio accounted for 48.5% M/S

Battery installation for

global electric vehicles (EV, PHEV, HEV) excluding the Chinese market sold from

January to November in 2023 was approx. 282.9GWh, a 48.8% YoY growth.

(Source:

Global EV and Battery Monthly Tracker – Dec 2023,

SNE Research)

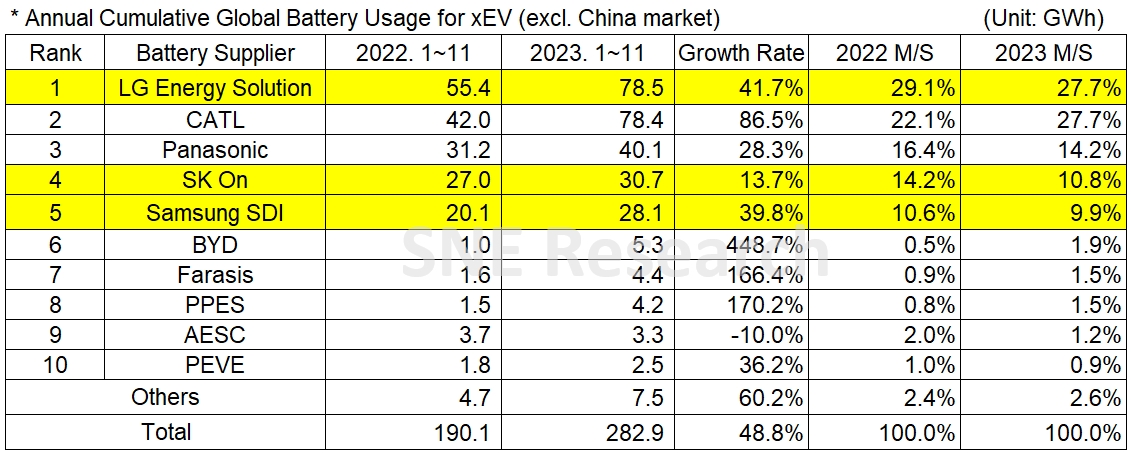

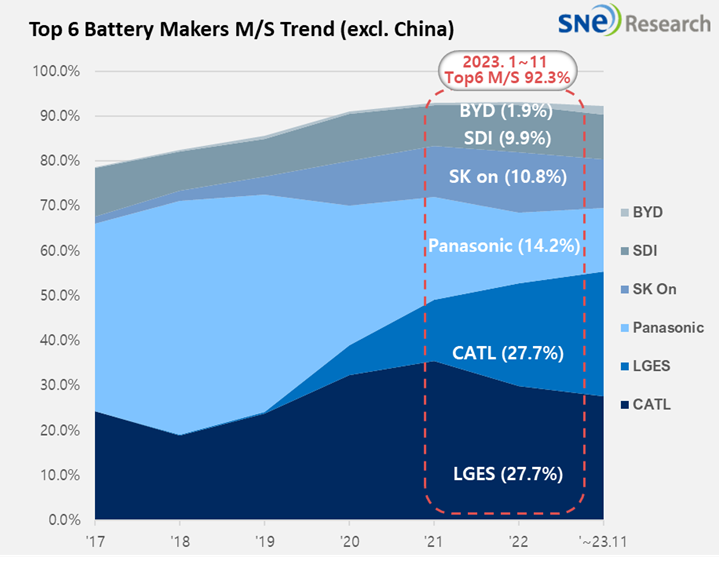

In the ranking of battery usage for electric vehicles, the K-trio battery makers all ranked within the top 5. LG Energy Solution remained on top of the list with a 41.7%(78.5GWh) YoY growth. SK On took the 4th position with a 13.7% (30.7GWh) growth, and Samsung SDI ranked 5th with a 39.8%(28.1GWh) growth. CATL from China has been rapidly expanding its market share, keeping a high growth momentum with an 86.5% (78.4GWh) growth.

(Source:

Global EV and Battery Monthly Tracker – Dec 2023,

SNE Research)

The combined shares of K-trio recorded 48.5%, a 5.4%p YoY decline from the same period last year, but the overall battery usage was in an upward trend. Their growth was mainly affected by favorable sales of electric vehicle models equipped with batteries of each company. Samsung SDI continued to be in an upward trajectory based on the increasing sales of BMW i4/iX and Audi Q8 e-Tron as well as decent sales of Rivian R1T/R1S and FIAT 500. SK On also recorded growth thanks to solid sales of Hyundai IONIQ 5, KIA EV6, Mercedes EQA/B and Ford F-150 Lightning. LG Energy Solution posted the highest growth among the K battery makers, supported by favorable sales of Tesla 3/Y, Volkswagen ID. Series, and Ford Mustang Mach-E that are very popular in Europe and North America.

Panasonic registered the battery usage of 40.1GWh, a 28.3% YoY growth. Panasonic, who is one of the major battery suppliers to Tesla, has most of its battery usage installed in Tesla models in the North American market. Tesla Model 3 experienced a temporary slowdown in sales when the facelift model was about to be sold in the market, but, instead, Model Y has driven the growth of Panasonic, showing an increase in sales compared to the same period of last year.

Along with CATL, some of the Chinese companies showed even higher growth in the non-China market than in the domestic market of China, rapidly expanding their presence in the global market. CATL’s battery is installed to Tesla Model 3/Y(made in China and exported to Europe, North America, and Asia) as well as vehicles made by major OEMs such as BMW, MG, Mercedes, and Volvo. Recently, CATL’s battery is installed to the new KONA model by Hyundai and KIA Ray EV model, meaning that the Chinese battery makers’ influence has been gradually expanding in the Korean market.

(Source:

Global EV and Battery Monthly Tracker – Dec 2023,

SNE Research)

As the IRA strengthened the requirements for tax credit granted for electric vehicles in 2024, the number of EV models eligible for US IRA tax credits reduced from 43 to 19 models. It seems those models, in which auto parts and materials made in China are used, have been ruled out, and the IRA requirements are expected to tighten further. Most of those models eligible for tax credits have the K battery, but, in terms of major battery materials, Korea is highly dependent on Chinese imports of precursor and minerals. Hopefully, the K-trio, cathode companies, and the government all would reach a consensus on the diversification of supply chain to solidify their positions in the non-China market in future.

[2] Based on battery installation for xEV registered during the relevant period.